In order to help you make the most of your plan and locate a therapist who fits within your budget, this guide describes understanding insurance benefits.

Options for paying for mental health therapy

Private insurance. If you have private health insurance, it’s likely that your plan will cover at least some of the cost of mental health therapy. That said, not every service falls under this category and there may be limitations on what is covered. For example, some plans cover a certain number of sessions per year, and some may only cover certain types of therapy (such as cognitive behavioral therapy).

Government insurance. Government programs such as Medicare cover many types of treatments for mental health issues—but there are still limitations on what is covered and how much it may cost you. You can check out the Medicare website or call them up directly if you’re interested in finding out more information about what services are covered under their program by calling 1-800-MEDICARE during standard business hours (Monday through Friday from 7am – 7pm) or visit their website at https://www.medicare.gov/. (Golden West Counseling currently does not accept Medicare or Medicaid insurance plans)

Superbill. You can also sign up for insurance reimbursement if your counselor doesn’t accept your insurance. Insurance reimbursement means that you’ll pay up front for your mental health therapy session, submit a Superbill (aka receipt of payment) to your insurance provider, and then your insurance provider will reimbursement you.

Check out Advekit. They are a service that helps clients navigate around seeking insurance reimbursement for mental health services and they make the process simple and easy to follow.

Self Pay. If none of these options work for you, there’s always self-pay. Self-pay means that you are paying out of pocket and not using insurance to cover any part of your care. Many people choose this option for reasons outside of not having mental health insurance benefits. For some individuals they value the privacy that self pay offers, especially in terms of keeping clinical notes private from insurance companies.

In Network vs Out of Network: What’s the Difference?

Let’s talk about how the process works.

A counselors decide which insurance networks they want to join. If a counselor has a contract with your health insurance carrier they are considered to be In-Network. —so for example if you have a PPO plan with Premera Blue Cross and your counselor is paneled with Premera Blue Cross, then that person belongs to your insurance’s list of approved In-Network Providers. Otherwise your counselor is considered Out of Network.

Many counselors also decide not to participate in health insurance networks. There are many reasons for this choice, but most counselors choose to not panel with insurance due to low compensation rates and administrative difficulty. Your chances of finding a counselor with a certain background, therapeutic modality, or personality may diminish as a result of the smaller pool of counselors that meet your needs within an insurance network.

A Note on Long Waitlists: Due to the strong demand for in-network counselors, reputable in-network counselors frequently fill up quickly. Long waitlists for appointments with in-network counselors is highly possible, particularly in major cities such as Seattle.

The Difference Between a Deductible, Copay and Coinsurance

Deductible: the amount you pay before your insurance coverage kicks in. If you have a $500 deductible and go to therapy for three sessions at $100 per session, then your total out-of-pocket cost is $300. You’re responsible for paying the deductible amount before your insurance kicks in and covers a portion or all of the cost of services.

Coinsurance: The percentage of cost that you are responsible for when visiting an approved provider. If your plan has 20% a coinsurance requirement, then you are responsible for 20% of each claim submitted by your providers.

Copay: The set amount that you are responsible for when visiting an approved health care provider.

For some insurance plans the deductible is not required to be met to use mental health benefits. This means you will only be required to pay your coinsurance or copay to receive your mental health benefits. Check your “services covered before deductible” in your insurance plan’s benefits!

Can My Copay/Deductible be Waived if I Can’t Pay?

It’s possible, however you must apply and qualify with your insurance company. The way this works is that the insurance company will evaluate your financial situation and determine whether they are willing to negotiate with you on your bill. You might be required to provide documentation supporting your claim, depending on what kind of waiver option the insurance plan offers.

Waiving these costs without approval from your insurance company is considered insurance fraud and could result in legal consequences for both the client and counselor involved.

It’s always best to check with your insurance company about your options.

Is There a Way to Get Free or Low Cost Therapy?

There are options for getting therapy at a lower cost or even no fee. Here are a number of options to check into:

- Employee Assistance Programs (EAPs) are offered by many companies as part of their benefits package. They allow employees to get help from a variety of professionals including mental health services. EAPs often cover a set number of sessions at no cost to you.

- If you have a disability and receive Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), or Veteran’s Administration benefits due to mental health issues, these programs may cover some or all the costs associated with your therapy sessions—but only if they’re provided by approved providers.

- If you’re in school, your school may have free or low-cost counseling services. Check with the student affairs office at your college or university to see what kind of programs they offer.

- Many colleges also offer low cost counseling services to the public at their College Counseling Center. If your local college has a Master’s degree in Counseling or Therapy chances are they also have a Counseling Center providing services to the public for a reduced fee.

- Check with our local Community Center or City Hall. Call your city/town’s local community engagement center to find out various low cost mental health services in your area.

- Ask counselors in your area if they offer sliding scale or reduced rate options. Many mental health providers keep a slot or two available for clients who are in a financial strain, but this varies from counselor to counselor.

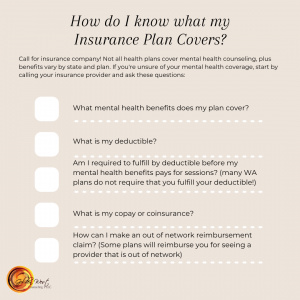

To understand your mental health insurance

benefits, begin by checking to see what

your mental health benefits include.

Call your insurance company. Not all health plans cover mental health counseling, plus benefits vary by state and plan. If you’re unsure of your mental coverage, start by calling your insurance provider and ask these questions.

● What mental health benefits your plan covers.

● What is your deductible?

● Are you required to fulfill your deductible before your mental health insurance plan pays for mental health benefits? (many plans do not in WA!)

● What is your copay/coinsurance?

● How can I make an out of network reimbursement claim and are there restrictions to who I can see for mental health services? (Some insurance companies will not reimburse providers with provisional licenses).

Seeing a mental health provider might be more affordable than you thought! Call us today to be connected with one of our skilled Counselors and begin making changes toward your New Year goals!